All Categories

Featured

Table of Contents

Costs are generally lower than entire life plans. With a level term policy, you can select your protection amount and the policy length. You're not locked into an agreement for the remainder of your life. Throughout your plan, you never have to stress over the premium or fatality advantage quantities altering.

And you can not pay out your policy throughout its term, so you won't receive any financial take advantage of your previous insurance coverage. As with various other sorts of life insurance policy, the price of a degree term policy depends on your age, protection requirements, work, lifestyle and wellness. Generally, you'll find extra economical coverage if you're more youthful, healthier and much less risky to insure.

Considering that degree term costs remain the same for the period of protection, you'll know precisely just how much you'll pay each time. That can be a large help when budgeting your expenditures. Level term insurance coverage also has some flexibility, permitting you to personalize your policy with added attributes. These typically can be found in the type of riders.

You might have to fulfill certain problems and certifications for your insurance company to establish this motorcyclist. In addition, there may be a waiting period of as much as 6 months before working. There additionally might be an age or time limit on the protection. You can include a child rider to your life insurance policy so it likewise covers your children.

What does a basic Low Cost Level Term Life Insurance plan include?

The survivor benefit is normally smaller sized, and coverage generally lasts till your kid turns 18 or 25. This rider might be a more cost-efficient way to assist ensure your kids are covered as bikers can often cover multiple dependents at as soon as. When your child ages out of this protection, it might be possible to convert the motorcyclist right into a brand-new plan.

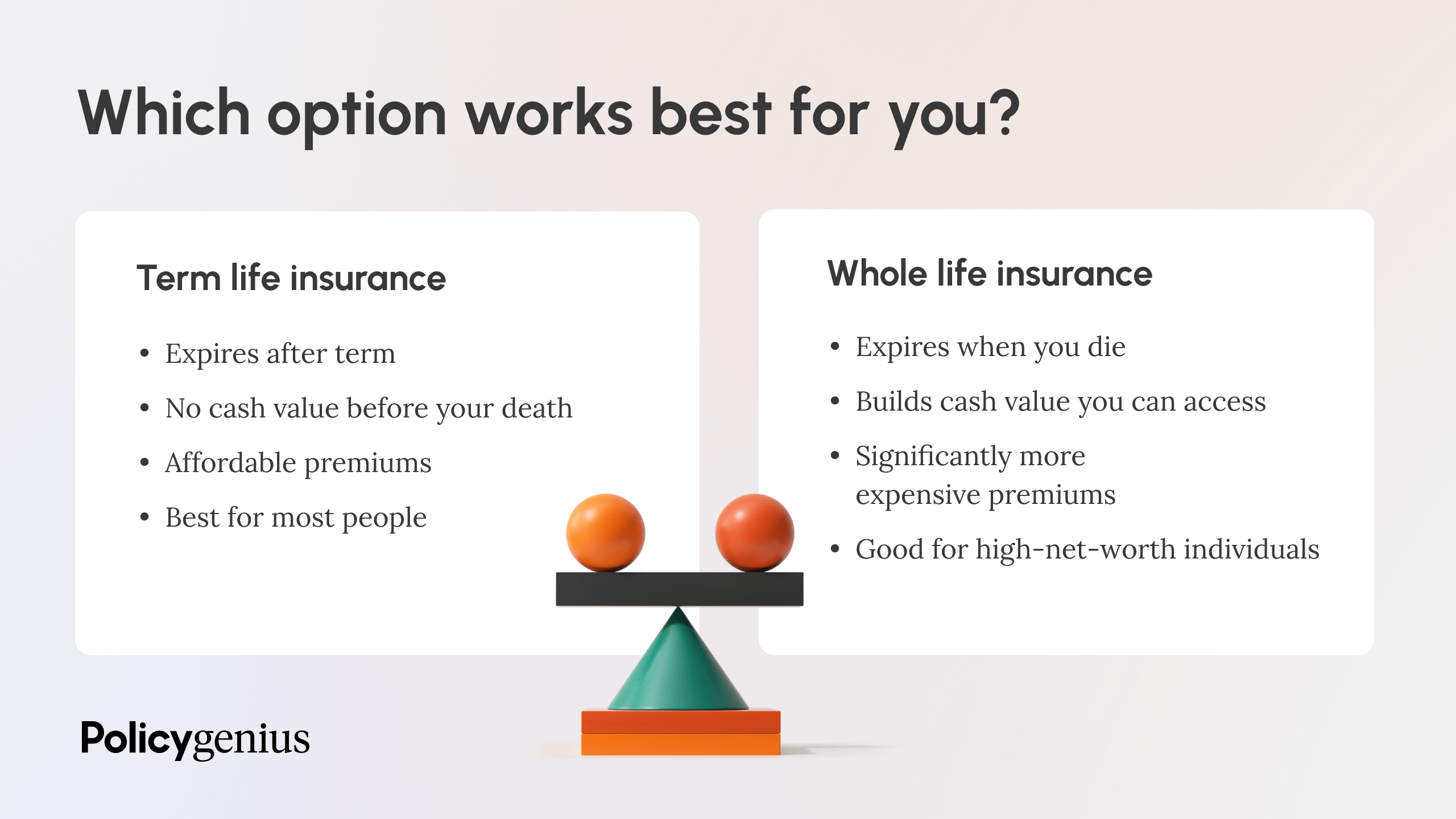

When contrasting term versus irreversible life insurance policy, it is necessary to keep in mind there are a few different types. The most typical kind of long-term life insurance coverage is whole life insurance policy, yet it has some vital distinctions compared to degree term insurance coverage. Right here's a fundamental summary of what to think about when contrasting term vs.

Whole life insurance coverage lasts forever, while term insurance coverage lasts for a specific duration. The premiums for term life insurance policy are generally less than whole life coverage. Nevertheless, with both, the premiums stay the very same for the duration of the plan. Whole life insurance policy has a money value component, where a part of the costs may grow tax-deferred for future demands.

Level Term Life Insurance For Seniors

One of the major features of degree term coverage is that your costs and your fatality benefit don't change. You may have insurance coverage that starts with a fatality benefit of $10,000, which could cover a home loan, and after that each year, the death advantage will lower by a set amount or percentage.

Due to this, it's commonly a much more budget friendly type of degree term insurance coverage. You may have life insurance policy with your employer, however it may not suffice life insurance policy for your needs. The initial step when buying a plan is figuring out just how much life insurance policy you need. Consider elements such as: Age Family members dimension and ages Employment standing Revenue Financial debt Way of living Expected last expenditures A life insurance policy calculator can help identify just how much you require to start.

After deciding on a plan, finish the application. If you're authorized, authorize the paperwork and pay your first costs.

You might desire to update your recipient information if you have actually had any kind of substantial life modifications, such as a marriage, birth or divorce. Life insurance coverage can in some cases feel complex.

Level Term Life Insurance Calculator

No, degree term life insurance policy doesn't have money value. Some life insurance coverage plans have a financial investment feature that allows you to build money worth in time. Level term life insurance benefits. A section of your premium repayments is alloted and can gain interest over time, which grows tax-deferred during the life of your coverage

Nonetheless, these plans are often significantly much more expensive than term coverage. If you get to completion of your policy and are still to life, the coverage ends. You have some alternatives if you still desire some life insurance policy coverage. You can: If you're 65 and your coverage has gone out, for instance, you might desire to get a new 10-year level term life insurance coverage policy.

What is the best Level Term Life Insurance Calculator option?

You might be able to convert your term protection right into a whole life plan that will last for the rest of your life. Lots of types of degree term plans are convertible. That implies, at the end of your insurance coverage, you can transform some or all of your policy to entire life insurance coverage.

Degree term life insurance coverage is a policy that lasts a collection term usually between 10 and three decades and comes with a level survivor benefit and degree costs that remain the exact same for the whole time the policy is in result. This suggests you'll understand precisely just how much your payments are and when you'll have to make them, allowing you to spending plan accordingly.

Level term can be a wonderful alternative if you're aiming to get life insurance policy coverage for the first time. According to LIMRA's 2023 Insurance coverage Measure Research, 30% of all adults in the U.S. need life insurance policy and don't have any kind of plan yet. Degree term life is foreseeable and budget-friendly, which makes it one of the most preferred sorts of life insurance policy

A 30-year-old man with a comparable profile can expect to pay $29 each month for the exact same coverage. AgeGender$250,000 protection amount$500,000 insurance coverage quantity$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Average monthly rates are computed for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

How can I secure Level Term Life Insurance For Seniors quickly?

Prices might vary by insurance firm, term, insurance coverage quantity, health class, and state. Not all policies are readily available in all states. It's the most inexpensive type of life insurance for many people.

It enables you to budget plan and prepare for the future. You can easily factor your life insurance policy into your spending plan due to the fact that the costs never alter. You can prepare for the future just as quickly because you know precisely just how much money your liked ones will certainly obtain in case of your absence.

What is the difference between Best Value Level Term Life Insurance and other options?

This holds true for individuals who stopped cigarette smoking or who have a wellness condition that fixes. In these cases, you'll typically have to go through a brand-new application procedure to get a much better rate. If you still need insurance coverage by the time your degree term life policy nears the expiry date, you have a few options.

Latest Posts

Best Final Expense Insurance

Whole Life Insurance Instant Quote

Aarp Burial Insurance Plans