All Categories

Featured

Table of Contents

Adolescent insurance gives a minimum of defense and might give protection, which could not be offered at a later date. Quantities given under such insurance coverage are typically restricted based on the age of the kid. The current restrictions for minors under the age of 14.5 would certainly be the better of $50,000 or 50% of the quantity of life insurance policy in pressure upon the life of the applicant.

Juvenile insurance might be offered with a payor advantage biker, which offers forgoing future premiums on the child's policy in case of the fatality of the individual that pays the premium. Senior life insurance policy, in some cases referred to as rated death advantage strategies, gives qualified older candidates with minimal entire life protection without a medical checkup.

The maximum concern amount of coverage is $25,000. These policies are generally a lot more pricey than a fully underwritten policy if the individual qualifies as a basic danger.

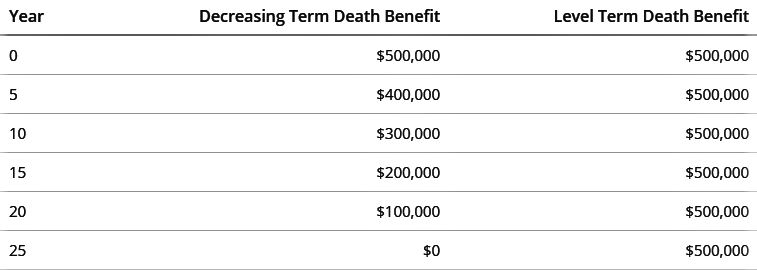

Our term life options consist of 10, 15, 20, 25, 30, 35, and 40-year plans. The most popular type is level term, suggesting your settlement (costs) and payment (survivor benefit) remains degree, or the very same, until completion of the term period. This is the most uncomplicated of life insurance coverage options and needs really little maintenance for policy owners.

How does Level Term Life Insurance Policy Options work?

You can offer 50% to your partner and split the rest amongst your grown-up children, a parent, a good friend, or also a charity. Level term life insurance quotes. * In some circumstances the survivor benefit might not be tax-free, find out when life insurance policy is taxed

1Term life insurance policy offers short-lived security for a crucial duration of time and is generally more economical than permanent life insurance policy. 2Term conversion standards and limitations, such as timing, might apply; as an example, there may be a ten-year conversion benefit for some products and a five-year conversion benefit for others.

3Rider Insured's Paid-Up Insurance Purchase Choice in New York City. 4Not available in every state. There is a cost to exercise this motorcyclist. Products and riders are readily available in authorized jurisdictions and names and features might differ. 5Dividends are not ensured. Not all getting involved plan proprietors are qualified for returns. For select riders, the problem relates to the guaranteed.

How do I apply for Level Term Life Insurance Benefits?

We may be compensated if you click this advertisement. Ad Level term life insurance coverage is a policy that provides the exact same death advantage at any type of point in the term. Whether you die on the very same day you secure a plan or the last, your recipients will get the exact same payout.

Which one you pick relies on your needs and whether or not the insurance firm will accept it. Plans can likewise last until specified ages, which in many situations are 65. As a result of the numerous terms it offers, level life insurance policy gives possible policyholders with flexible alternatives. Beyond this surface-level information, having a greater understanding of what these strategies require will help guarantee you acquire a policy that fulfills your demands.

Be mindful that the term you select will influence the costs you pay for the plan. A 10-year degree term life insurance coverage plan will certainly cost less than a 30-year policy since there's less opportunity of a case while the strategy is active. Lower threat for the insurance company corresponds to decrease costs for the policyholder.

Level Term Life Insurance Coverage

Your family members's age must additionally affect your policy term choice. If you have little ones, a longer term makes sense because it safeguards them for a longer time. However, if your youngsters are near the adult years and will certainly be monetarily independent in the close to future, a shorter term may be a much better fit for you than a prolonged one.

When contrasting whole life insurance policy vs. term life insurance coverage, it's worth noting that the latter generally prices less than the previous. The result is extra insurance coverage with reduced premiums, offering the best of both worlds if you need a significant amount of insurance coverage but can't pay for an extra pricey plan.

Why should I have 20-year Level Term Life Insurance?

A level death benefit for a term policy normally pays out as a swelling sum. Some level term life insurance policy companies permit fixed-period repayments.

Interest settlements obtained from life insurance policy policies are thought about earnings and undergo tax. When your level term life policy runs out, a couple of various points can take place. Some protection ends immediately without option for revival. In various other scenarios, you can pay to expand the strategy beyond its initial day or transform it right into a permanent plan.

The drawback is that your sustainable level term life insurance policy will certainly come with greater premiums after its preliminary expiry. We may be made up if you click this advertisement.

Who offers Guaranteed Level Term Life Insurance?

Life insurance policy business have a formula for determining danger making use of mortality and passion. Insurance companies have countless customers obtaining term life plans at as soon as and use the costs from its energetic plans to pay enduring beneficiaries of various other policies. These companies utilize mortality tables to estimate the amount of individuals within a particular group will file death insurance claims each year, and that details is utilized to figure out ordinary life span for possible policyholders.

In addition, insurer can invest the cash they obtain from premiums and raise their earnings. Because a level term policy does not have money value, as an insurance holder, you can not invest these funds and they do not supply retirement income for you as they can with entire life insurance policy plans. The insurance policy company can spend the cash and gain returns.

The following section details the benefits and drawbacks of level term life insurance policy. Predictable costs and life insurance protection Simplified policy framework Prospective for conversion to long-term life insurance policy Limited coverage period No cash value buildup Life insurance premiums can boost after the term You'll locate clear benefits when contrasting degree term life insurance policy to other insurance coverage types.

Who offers flexible No Medical Exam Level Term Life Insurance plans?

From the minute you take out a policy, your costs will never change, aiding you plan financially. Your coverage won't differ either, making these plans efficient for estate planning.

If you go this path, your premiums will certainly increase however it's constantly good to have some versatility if you wish to keep an energetic life insurance policy policy. Eco-friendly degree term life insurance coverage is one more option worth taking into consideration. These policies enable you to keep your existing plan after expiration, offering flexibility in the future.

Latest Posts

Best Final Expense Insurance

Whole Life Insurance Instant Quote

Aarp Burial Insurance Plans